people's pension higher rate tax relief

Ad See the Top 10 Tax Debt Relief. - As Heard on CNN.

Tax Relief On Additional Voluntary Contributions

Solve Your IRS Tax Debt Problems.

. Ad You Dont Have to Face the IRS Alone. Under the relief at source method the pension provider always claims tax relief at the basic rate 20. Additional-rate taxpayers can claim 45 pension tax relief.

Intermediate rate taxpayers pay 21 income tax and can claim 21 pension tax relief. The amount you receive is based upon your current marginal rate of tax. Compare the Top Tax Debt Relief and Find the One Thats Best for You.

They will only have received tax relief at 20 on their contributions rather than 40. You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. If your pension contributions have been deducted from net pay after tax has been deducted and youre a higher rate taxpayer eg paying 40 tax you can claim your tax back in two ways.

Get the Help You Need from Top Tax Relief Companies. 1 up to the amount of any income you have paid 21 tax on. Resolve Your Tax Issues Today.

If you are a higher-rate taxpayer you could reclaim an additional 20 tax on your pension contributions for a total of 40 tax relief. He said If the rate. Compare 2022s 10 Best Tax Relief Companies.

21 up to the. Get Instant Recommendations Trusted Reviews. Ad BBB A Rating.

There are two ways for higher rate tax relief to be claimed on a personal contribution to a personal pension. Ad You Dont Have to Face the IRS Alone. Those paying 40 income tax are entitled to 40 pensions tax relief on contributions and 50 taxpayers are entitled to 50 tax relief although this will drop to 45.

When you earn more than 50000 per year you can claim an additional tax relief either an extra 20 for higher rate taxpayers or 25 for additional rate taxpayers to be added to your pension. This is one of the biggest benefits of saving. If youre a basic-rate taxpayer you will receive 20 tax relief on your personal pension payments 40 if.

Through the annual self-assessment tax return. Basic-rate taxpayers get 20 pension tax relief. If an employee does not earn enough to pay Income Tax they can still receive tax relief.

Higher rate tax relief can be claimed. They claim this from the government and add this to your pension pot. Solve All Your IRS Tax Problems.

Resolve Your Tax Issues Today. The Autumn Statement said that in 2010-11 tax relief for pension savings cost the Government around 33bn - with over half of this relief going to higher rate taxpayers. If your employees dont pay tax as their earnings are below the annual standard personal allowance 12570 theyll still get tax relief on their pension contributions at the basic rate of.

Solve All Your IRS Tax Problems. Steven Cameron pensions director at Aegon warns that reducing or abolishing higher-rate tax relief will deter some higher earners from pension saving. Get the Help You Need from Top Tax Relief Companies.

So as long as. There are two ways for higher rate tax relief to be claimed on a personal contribution to a personal pension. Ad BBB A Rating.

Higher-rate taxpayers can claim 40 pension tax relief. Compare 2022s 10 Best Tax Relief Companies. When you earn more.

- As Heard on CNN. Basic rate taxpayers pay 20 income tax and get 20 pension tax relief.

Public Sector Pensions Worth 80 More Than Those In Private Sector

.jpg)

Income Tax Relief Pensions Irish Life

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

60 Tax Relief On Pension Contributions Royal London For Advisers

How To Navigate The Annual Allowance Taper Brewin Dolphin

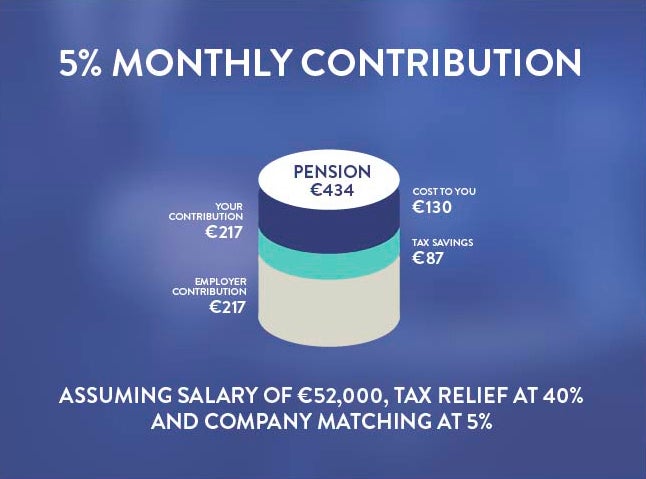

Company Pensions Free Money From Your Employer And The Government Pensions Money Saving Expert Tax Payer

Your Handy Guide To Company Pensions

Claiming Tax Back On Pension Contributions Irish Tax Rebates

Reform Of Pension Tax Relief House Of Commons Library

Tax Relief On Additional Voluntary Contributions

Pension Tax Relief Cost Hits 42bn Ftadviser Com

Workplace Pension Contributions The People S Pension

Employee Tax Relief Brightpay Documentation

60 Tax Relief On Pension Contributions Royal London For Advisers

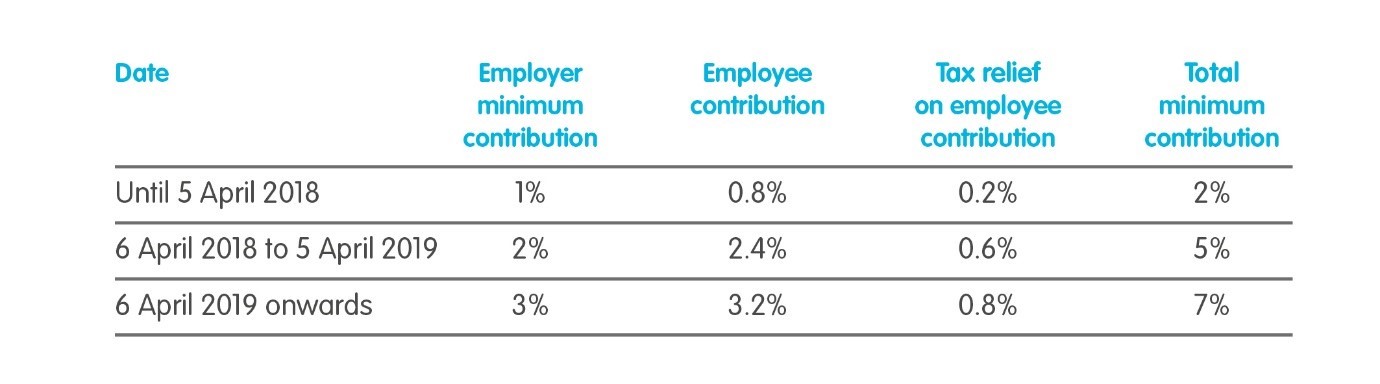

What Are The Minimum Contribution Levels When Pensionable Or Total Earnings Basis Is Used Help And Support

How Pension Tax Relief Works And How To Claim It Wealthify Com