ct sales tax exemptions

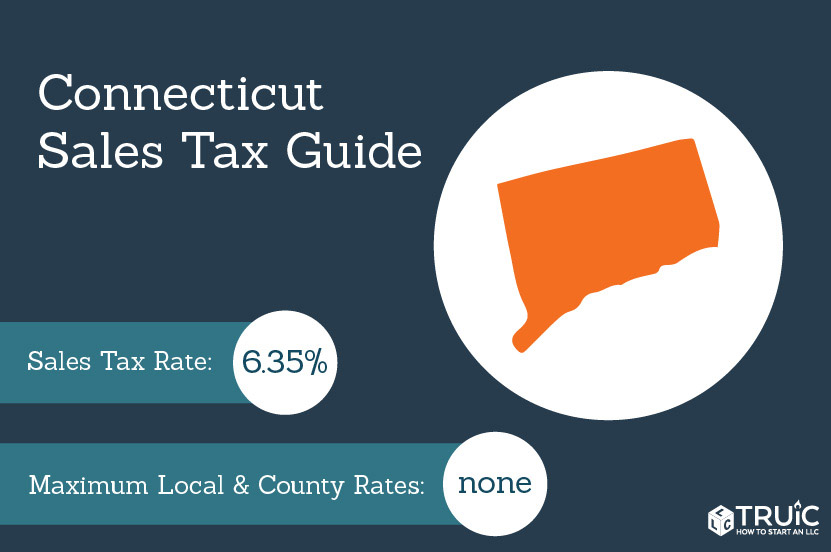

Sales tax is charged at a rate of 635 vessels and trailers that transport vessels are at 299 sales tax rate except for those vehicles that are exempt from sales tax. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is.

Form Reg 8 Fillable Farmer Tax Exemption Permit

2022 Connecticut state sales tax.

. What is Exempt From Sales Tax In Connecticut. 12-412 Exemptions Policy Statement 20151 DC CDCR 9-419 Sales and Use tax CDCR 9-492. There are exceptions to the 635 sales and use tax rate for certain goods and services.

There are exceptions to the 635 sales and use tax rate for certain goods and services. General Sales Tax Exemption Certificate. Exemption from sales tax for services.

An organization that was issued a federal Determination Letter of. How to use sales tax exemption certificates in Connecticut. 7 on certain luxury motor vehicles boats jewelry clothing and.

Exact tax amount may vary for different items. Sales Tax Relief for Sellers of Meals. For tax exemption you must present a valid Farmers Tax.

Sales and Use Tax Information. 2022 Connecticut state sales tax. The Connecticut Sales Tax is administered by the Connecticut Department of Revenue Services.

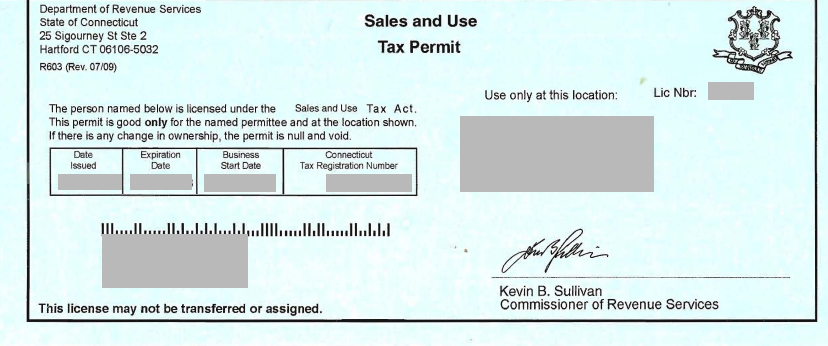

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. Exemption from sales tax for items purchased with federal food stamp coupons. While the Connecticut sales tax of 635 applies to most transactions there are certain items that may be exempt from taxation.

IMPORTANT INFORMATION - the following tax types are now available in myconneCT. Beginning on the July 1st 2011 the state of Connecticut levies a 635 state sales tax on the retail sale lease or rental of most goods. Factors determining effective date thereof.

Individual Income Tax Attorney Occupational Tax Unified Gift and Estate Tax Controlling Interest. Exact tax amount may vary for different items. You can learn more by visiting the sales tax information website at wwwctgov.

Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is. This page discusses various sales tax exemptions in.

44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut. This vehicle is exempt from the 635 Connecticut salesuse tax if its used directly in the agricultural production process. Exemptions from Sales and Use Taxes.

Tax Exemption Programs for Nonprofit Organizations. SalesTaxHandbook has an additional five Connecticut sales tax certificates that you may need. Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations.

7 on certain luxury motor vehicles jewelry clothing and footwear. Are drop shipments subject to sales tax in Connecticut. Manufacturing and Biotech Sales and Use.

FilmTVDigital Media Tax Exemptions Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. FYI Sales 63 Notice see p7 Connecticut Conn.

The Complete Guide To Managing Sales Tax Exemption Certificates

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

Wayfair Dramatically Changes Drop Shipment Sales Tax Obligations Exemptax Blog

Cert 134 Fill Out Sign Online Dochub

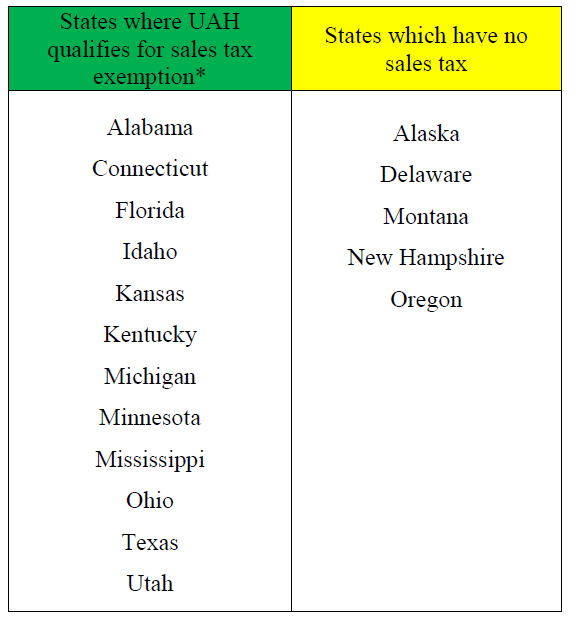

Uah Business Services News Tax Exemption Guidelines

Connecticut Sales Tax Guide For Businesses

_0.png)

Map State Sales Taxes And Clothing Exemptions Tax Foundation

Download Business Forms Premier1supplies

Assessment Of Sales Tax On Labor In The State Of Ct Sapling

Back To School Shopping Connecticut Tax Free Week Begins With Many Retail Items Under 100 Exempt From State Sales Tax Abc7 New York

Connecticut Sales Tax Calculator Reverse Sales Dremployee

How To File And Pay Sales Tax In Connecticut Taxvalet

Is Food Taxable In Connecticut Taxjar

Sales Tax Victory In Connecticut Planetlaundry

What To Know About Ct S 2022 Sales Tax Free Week Nbc Connecticut

Connecticut Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Tax Holidays The Cpa Journal